1. American Express Serve

American Express used to be considered a company for those with higher incomes. With the release of credit cards along with charge cards, this reputation changed and the company became open to more individuals. Now, with American Express Serve, as well as Bluebird, American Express is open to just about anyone. For only $1 a month if you don’t use Direct Deposit or load less than $500 a statement, you can enjoy a prepaid debit card with some of the same benefits I enjoy as an American Express credit card holder. ATM is free at a variety of select locations. Serve is loadable at thousands of locations across the US.

2. GreenDot Card

Greendot is considered by many to be a top prepaid debit card to choose. The card is free to purchase online. You do have a higher monthly fee of $4.95 compared to American Express. However, if you load more than $1000 a statement, it is a waived fee. In addition, unlike having to either load $500 or use Direct Deposit with American Express to be eligible for a fee waiver, you can have fees waived with Greendot by making 30 or more purchases of any value in a statement. ATM access is free at select locations.

3. Simple

Simple has a unique concept compared to the other cards listed in this article. This Visa card is focused more on saving rather than spending for the individual. You are able to make goals, partitioning money to a specific part of your card reminiscent of a savings account but without being able to make interest. This is all on a contemporary, mobile phone-focused experience. Simple is very simple to sign up for and the savings benefits is a big draw for individuals. It is free to get and there are no fees as long as you keep the card active at least once within a six month period. There are other fees, including when you perform ATM withdrawals internationally, however they are small. You can access your money for free at over 55,000 ATMs across the country.

4. H&R Emerald Prepaid MasterCard

The H&R Emerald Card with MasterCard is a great option from the company that we all know of with filing taxes. The Emerald Card doesn’t come with any monthly fees. There is a one-time loading fee of $4.95 to get started. ATM fees are $2.50, regardless of where you go. That’s a big reason why it isn’t in the top half of our list. However, the quality of the card and company behind it, along with the lack of monthly fees makes it a very competitive card. Just like all of the cards mentioned on the list, the FDIC insurance protects you as a user, ensuring that your money is safe and secure.

5. BB&T Money Account

The BB&T Money Account card makes the lower half of our list due to the fees associated with the card. While there are a fewer number of fees compared to the other cards on the list, one thing that is certain with this card is that you will pay something every month. As long as you use a BB&T ATM domestically, you are safe from those fees. However, you can’t escape the $6 a month fees that come with holding the card. Even if you load $1000 or more a month, this fee only reduces to $3 a month. If you are a student, look into their special card for the younger crowd, you’ll always pay $3 a month, no matter what. Despite this, it is a card we can recommend because the BB&T name behind this card is very strong. You’ll have almost no trouble finding a BB&T ATM to use, and the features with this card are numerous.

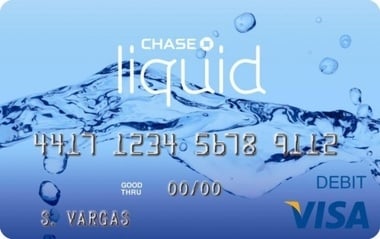

6. Chase Liquid

Chase is a well known credit card company, but little did you know, their prepaid debit cards are just as good. If you are in the market for a debit card, you may find them even better. Their monthly fee of $4.95 makes it the most expensive on the list. Yes, while the Greendot card allows you to get out of the monthly fee if you deposit $1000, there’s no such grace period with the Chase Liquid card. Despite this, chances are you won’t be paying anything else. You can use the Chase app to keep track of your transactions, and this card comes with most of the same features mentioned about the other cards in this article. With the name Chase having your back, this is a great card and one of the best to finish off this list. Now that you know which of the best prepaid debit cards are out there, why not go out and get one for yourself today. Featured photo credit: Financial Queries via financialqueries.com